Scientific Climate Ratings: Turning Climate Science into Financial Insights

- Climate change is now a tangible and urgent concern, with both physical and transition risks presenting significant financial consequences.

- Institutional investors managing long-term portfolios need science-based climate ratings, which assess the financial materiality of these risks and quantify the asset value at stake.

- Scientific Climate Ratings, an EDHEC venture, turns climate science into financial insights, through independent, forward-looking, comparable ratings developed by the EDHEC Climate Institute.

- Through an on-demand global ratings map, we assess exposure to physical (floods, heat, wildfires, storms) and transition risks (Scope 1, 2, and 3 emissions), and quantify the dollar impact.

- In 2025, 6,000+ infrastructure assets across 25 countries are rated, with plans to expand to 5,000+ leading listed companies worldwide in 2026.

Climate risks are intensifying worldwide, as global warming accelerates at an unprecedented pace.[1] Global temperatures exceeded 1.5°C above pre-industrial levels in 2024, a critical threshold outlined in the Paris Agreement.[2] Climate change is no longer a distant financial concern[3], nor a “Tragedy of the Horizon”, a phrase coined by former Bank of England Governor Mark Carney in a historic speech in 2015.[4] Physical risks, such as floods, storms, wildfires, and heat, as well as transition risks arising from the shift to a low-carbon economy, are immediate threats affecting our lives and financial systems.

Investors are increasingly recognizing these risks, which manifest as direct damage to vulnerable assets, value losses, or stranded assets (relying heavily on fossil fuels). According to the research conducted by the EDHEC Infrastructure & Private Assets Institute, investors could face more than 50% portfolio value loss due to physical risks in the event of a “runaway climate change” [5].

For institutional investors, it is essential to understand the level of exposure and potential value loss when managing long-term portfolios, especially for vulnerable assets such as infrastructure. However, despite the need for systematic evaluation of these risks, a significant gap remains: Most climate risk solutions and ESG scores stop at flagging risks, without quantifying the financial materiality of climate risks.

Scientific Climate Ratings, an EDHEC venture, was established in June 2025 to address this gap by providing science-based, forward-looking ratings that translate climate risk exposure scores to concrete financial metrics, through 2035 and 2050. Born out of research from the EDHEC Climate Institute, the agency provides two rating outputs, the Potential Climate Exposure Ratings (PCER) and the Effective Climate Risk Ratings (ECRR). The ratings are adjusted to reflect company-specific adaptation strategies using ClimaTech, the world’s largest knowledge base for infrastructure decarbonization and resilience[6].

This article aims to provide in-depth, scientific, and industry-specific insights into climate risks, highlighting the importance of assessing their financial impact for institutional investors. It explains why most climate data solutions and ESG scores fall short of providing reliable, actionable insights, and outlines how science-based climate risk assessments can empower investors with decision-useful financial metrics, supporting resilient portfolios.

Climate Risks Explained: Physical and Transition

Climate risk, in general terms, refers to potential negative (“adverse”) consequences that arise from the interaction with climate hazards, affecting human or ecological systems, according to the Intergovernmental Panel on Climate Change (IPCC). [7] Risks may arise not only from the potential impacts of climate change but also from human responses to it. These adverse consequences include the negative impacts on economic, social and cultural assets as well as investments, infrastructure, and services.

Climate-related risks manifest in two distinct forms according to widely adopted frameworks highlighted in the investment and finance literature: Physical and Transition risk.[8]

- Physical Risk: It arises from direct, physical impacts of a changing climate, such as extreme weather events and long-term environmental changes.[9] They can be acute risks, such as floods, wildfires, storms and heat, or chronic risks such as rising sea levels, rising mean temperatures and changes in precipitation patterns. [10]

These risks cause immediate, observable damage to assets and operations. They can affect cash flows and create both operational and reputational risks. They can also increase supply chain costs and reduce demand, making them a direct concern for investors and issuers. In the example of the 2018 Camp Fire in California, wildfire liabilities have pushed a major utility to the brink of bankruptcy, illustrating the solvency risk that arises when hazards escalate.[11]

Box 1: Example of 2024 Spain floods

The flash floods in Spain in 2024 offer a concrete example of physical risks in action, illustrating how localised, asset-level (micro) disruptions can scale into broader (macro-level) economic consequences[12].

At the micro level, critical infrastructure such as roads, bridges, railways, and power grids was severely damaged, leading to operational disruptions. At the macro level, the floods triggered insurance claims estimated as more than €3.5 billion[13] and caused an estimated 0.2 percentage point drop in GDP for the fourth quarter of 2024, according to the Bank of Spain.[14]

- Transition Risk: It derives from the global shift towards a low-carbon economy, associated with changes to address mitigation and adaptation requirements. These risks are categorised into four main types by the Task Force on Climate-related Financial Disclosures (TCFD): policy, reputation, technology, and market[15].

For instance, the shift towards net-zero carbon emissions in Germany under strict climate policies led to several “stranded assets” (some coal-fired power plants and other “fossil fuel” assets) due to changes in the market or regulations.[16]

Box 2: Types of Transition Risks (TCFD)[17]

Policy (and legal) risk stems from changes in policy regulations (e.g., the European Green Deal, launched in 2019), which aim to promote adaptation and constrain actions that contribute to adverse impacts. For instance, implementing carbon-pricing mechanisms to target the reduction of greenhouse gas emissions, or measures to increase water efficiency for sustainable practices, can result in increased operational costs. These changes can reduce the long-term value of certain infrastructure assets, particularly those that rely on high-carbon activities, leading to “stranded assets” risks.

Technology risk arises from emerging technologies and innovations such as renewable energy and carbon capture and storage, which can change the competitive landscape and production/distribution costs of certain organizations, and disrupt parts of the existing business models.

Market risk refers to shifts in supply and demand for certain products and services, considering both climate risks and opportunities into account.

Reputation risk arises when public and stakeholder perceptions shift regarding an organization’s stance on the transition to a low-carbon economy.

The infographic below (Figure 1) highlights their key distinctions and real-world relevance.

Figure 1: Physical Risk vs Transition Risk[18]

Source: TCFD, Bank of Spain

Box 3: How Much Will Climate Risk Cost?

Climate-related physical and transition risks are impacting the stability of long-term investments and leading to substantial value losses. Institutional investors may face a potential loss of USD10.7 trillion in portfolio value triggered by the materialization of climate risks, according to a study by the World Bank Group[19].

Research by the EDHEC Infrastructure & Private Assets Institute (EIPA) indicates that these risks are already material for several pension funds with significant exposure to infrastructure assets, which are inherently vulnerable to intensifying weather extremes such as floods. Investors could lose more than 50% of the value of their portfolio to such physical risks before 2050 in the event of runaway climate change, according to the Institute.[20]

Box 4: The Case Study: A Canadian Pension Fund[21]

The case study on the portfolio of a large Canadian pension fund conducted by EIPA demonstrates how climate risks have materialized impacts on pension fund portfolios with infrastructure assets. This pension fund comprises 13 assets, two of which are exposed to severe flood events. The study indicated that potential damages to these two assets, if materialized, could cost USD190 million of the equity value in the aggregate of the pension fund’s portfolio, although these assets weigh only 1% and 7% in the portfolio, respectively.

The Limitations of ESG Scores and Generic Climate Data Providers

While managing the impacts of climate risks is becoming an essential consideration for the investment community[22], a significant gap remains in how these risks are assessed and priced. Most climate assessment solutions available are not designed to quantify the financial materiality of climate risk. Many climate data providers purely focus on exposure to climate risk, emissions and hazards, and cannot link generated information to asset values.

Environmental, Social, and Governance (ESG) ratings and scores, which provide information about the sustainability performance of a company or a financial instrument, are widely used for assessing exposure to climate risks. These tools have played an important role for investors, who use ESG ratings as part of their sustainability strategies and comply with climate regulations and objectives.[23] However, there are ongoing discussions about the transparency and objectivity of these ratings, whose methodologies and data collection methods vary widely. [24] [25] These scores also blend several different factors (governance, social and environmental), which can obscure the financial materiality.

In this context, investors predominantly rely on these available tools, which overlook the financial impacts of climate risks that could arise in the future, and lack the foundation of a robust financial modelling or a credible, scientifically grounded methodology.

Scientific Climate Ratings: Quantifying the Financial Materiality of Climate Risk

Scientific Climate Ratings, developed by the EDHEC Climate Institute, was established in June 2025 to address this gap, leveraging its unique position as the first ratings agency focused exclusively on the financial impact of climate risk. Our mission is to provide science-led, forward-looking climate risk ratings utilizing transparent, granular and comprehensive data to support informed, actionable decisions for investors.

“While climate risks are accelerating, investors and issuers often treat these risks as nonfinancial or too vague, and financial decisions often lag behind. Also, existing ESG and climate assessment tools tend to be generic, qualitative or disconnected from financial consequences, and climate risk is usually diluted within broader environmental, social and governance scores. Our goal is to correct that by offering forward-looking, science-based ratings that translate into concrete financial metrics,” explains Rémy Estran-Fraioli, CEO of Scientific Climate Ratings.[26]

Our data and methodology are grounded in peer-reviewed climate models, and globally recognized hazard projections, including those of the UN Intergovernmental Panel on Climate Change (IPCC) and Copernicus, the Earth observation component of the European Union’s Space Programme.

Launched as part of EDHEC Business School’s 2024-2028 strategic plan, “Generations 2050”, Scientific Climate Ratings is rooted in EDHEC’s applied research ecosystem in Finance and Climate Finance.[27] Our methodology was born out of decades of rigorous research conducted by the EDHEC Climate Institute, which addresses the financial implications of climate change. The agency also leverages foundational research from sister ventures, including Scientific Infra & Private Assets (SIPA), the EDHEC Infrastructure & Private Assets Research Institute (EIPA) and Scientific Portfolio.

Our standardized, transparent and comparable ratings set a new global benchmark for climate risk assessment, providing several competitive advantages:

- Dual approach to climate risk: We assess the financial materiality of both physical and transition risks for a more complete picture.

- Two ratings, one holistic view: The variability and complexity of climate impact require more than a single rating focusing on pure exposure. Our ratings encompass two outputs to deliver actionable financial insights:

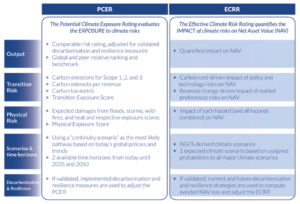

The Potential Climate Exposure Rating (PCER) measures future climate exposure under a “continuity” policy scenario, through 2035 and 2050. PCER ratings are presented on a scale from A (low exposure) to G (high exposure), allowing for clear peer comparison.

- Computes Scope 1, 2, and 3 emissions to measure transition risk exposure accurately.

- Uses precise geolocation and asset boundaries to evaluate physical risk exposure.

- Accounts for adaptation efforts and their effectiveness, leveraging the comprehensive ClimaTech database.

- Translates the final exposure into a score and a rating designed for peer comparison.

The Effective Climate Risk Rating (ECRR) quantifies dollar impact expressed as Net Asset Value (NAV), by weighting a range of probabilities assigned to climate scenarios, including both physical and transition pathways, through 2035 and 2050 (rated from A to G).

- Calculates expected impact due to transition risk by analyzing carbon costs and revenue growth.

- Computes expected impact due to physical risk through detailed geolocation and asset boundaries.

- Expressed as NAV impact, reflecting effects on cash flow and overall valuation.

- Accounts for adaptation efforts and their effectiveness by utilizing the ClimaTech database.

- Translating the final exposure score into the ECRR for peer comparison.

Figure 2: Two Ratings, One Holistic View: Quantifying Financial Impact of Climate Risk with PCER and ECRR

The table below illustrates how our PCER and ECRR assess climate risk exposure and its financial impacts across diverse scenarios, time horizons, and asset types. Together, the PCER and ECRR provide a holistic and science-led assessment, empowering investors and issuers to receive both a precise understanding of potential exposure and a direct, monetised assessment of future climate risks.[28]

Source: Scientific Climate Ratings

- Assigns probabilities to climate scenarios: We evaluate risk across a full range of climate pathways, each with assigned probabilities. This allows our ratings to shift the focus from a theoretical approach based on isolated “what if” scenarios to understand “what is likely”. We assess risk across scenarios through two critical time zones: 2035 and 2050. [29]

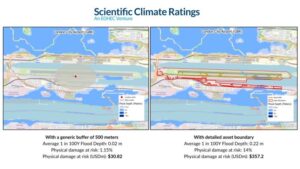

- Precise geoshape extraction: Generic market solutions estimate physical risks using a generic radius approach. We assess climate risk using detailed geoshape extractions and high-resolution data, as precise spatial footprints are crucial for accurate risk assessments.

Figure 2: Generic Buffer Approaches vs Detailed Asset Boundary: The Example of London City Airport

Climate risk is granular and asset specific. Two infrastructure assets can face vastly different exposures due to minor geographic differences or other factors such as ground elevation or proximity to water. Precise spatial granularity is essential for accurate risk assessments. At Scientific Climate Ratings, we reflect the true footprint of each asset, using detailed asset boundaries.

In the example of London City Airport, the generic radius approach (demonstrated on the left) underestimates flood depth and damage by a factor of ten (calculating it at USD30.82m), compared to our method (on the right) using detailed asset boundaries, calculating USD 357.2m in potential damage.

- Ratings adjusted to reflect adaptation and resilience strategies: We incorporate ClimaTech, the largest global knowledge base for infrastructure decarbonization and resilience strategies, to re-evaluate and adjust our ratings. Backed by two years of applied research, ClimaTech offers a science-based matrix that maps strategies by infrastructure type and evaluates their levels of effectiveness, enabling evidence-based decisions and enhancing resilience.[30]

References:

[1] NASA (2024). Evidence: Climate Change – Evidence. Available here: https://science.nasa.gov/climate-change/evidence

[2] Copernicus (2024). Global Climate Highlights 2024. Available at: https://climate.copernicus.eu/global-climate-highlights-2024

[3] Blanc-Brude, F. (2023). Climate risk: Not the day after tomorrow. Guest comment in Infrastructure Investor, November 2023. Available here: https://www.edhecinfraprivateassets.com/wp-content/uploads/2023/11/EDHECinfra_Physical-risk_Infra-Investor_Nov-2023.pdf

[4] Cipollone, P. (2024). Europe’s tragedy of the horizon: the green transition and the role of the ECB. Speech by Piero Cipollone, Member of the Executive Board of the ECB, Festival dell’Economia di Trento, 26 May 2024. Available here: https://www.ecb.europa.eu/press/key/date/2024/html/ecb.sp240526~ef011def12.en.html

[5] Marcelo, D., F. Blanc-Brude, N. Amenc, A. Gupta, B. Jayles, and N. Manocha (2023). It’s Getting Physical. Available here: https://ssrn.com/abstract=4784951or http://dx.doi.org/10.2139/ssrn.4784951

[6] EDHEC Climate Institute (2025). Resilience & Transition Tech. Available here: https://climateinstitute.edhec.edu/resilience-transition-tech

[7] Reisinger, A., M. Howden, C. Vera et al. (2020). The Concept of Risk in the IPCC Sixth Assessment Report: A Summary of Cross-Working Group Discussions.Available here: https://www.ipcc.ch/site/assets/uploads/2021/01/The-concept-of-risk-in-the-IPCC-Sixth-Assessment-Report.pdf?utm_source=chatgpt.com

[8] Reisinger, A., M. Howden, C. Vera et al. (2020)

[9] Physical Climate Risk Assessment: Practical Lessons for the Development of Climate Scenarios with Extreme Weather Events from Emerging Markets and Developing Economies. World Bank / NGFS. Available here: https://documents1.worldbank.org/curated/en/099657511082325958/pdf/IDU0004b1eec0d7f304e7c0967305183f75f92a2.pdf

[10] Environmental Protection Agency (2025). Climate Risks and Opportunities Defined. Available here: https://www.epa.gov/climateleadership/climate-risks-and-opportunities-defined

[11] Scientific Climate Ratings (2025). From Hazards to Losses: Our CSO on the Financial Cost of Physical Climate Risk. Available here: https://scientificratings.com/2025/08/04/from-physical-climate-hazards-to-financial-losses-qa-with-the-chief-scientific-officer-of-scientific-climate-ratings/

[12] World Meteorological Organization (2024). Devastating Rainfall Hits Spain in Yet Another Flood-Related Disaster. News item, 31 October 2024. Available here: https://wmo.int/media/news/devastating-rainfall-hits-spain-yet-another-flood-related-disaster

[13] Spanish Floods Will Cost Insurers Over $3.8 Billion. Bloomberg, 8 November 2024. Available here: https://www.bloomberg.com/news/articles/2024-11-08/spanish-flood-insurance-claims-to-top-3-5-billion-moody-s-says

[14] Bank of Spain Estimates Floods Cost 0.2% of GDP in 4th Quarter. Insurance Journal, 20 November 2024. Available here: https://www.insurancejournal.com/news/international/2024/11/20/801861.htm

[15] Task Force on Climate-related Financial Disclosures (2021). Climate-related Risks and Opportunities. Available here: https://www.tcfdhub.org/Downloads/pdfs/E06%20-%20Climate-related%20risks%20and%20opportunities.pdf

[16] Meinerding, C., Y. Schüler, and P. Zhang (2024). Consequences of Transiting to a Climate-Neutral Economy (Research Brief No. 68 – August 2024). Deutsche Bundesbank. Available here: https://www.bundesbank.de/en/publications/research/research-brief/2024-68-transition-risk-765322

[17] Task Force on Climate-related Financial Disclosures (2021).

[18] Task Force on Climate-related Financial Disclosures (n.d.). Climate-Related Risks and Opportunities. Available here: https://www.tcfdhub.org/Downloads/pdfs/E06%20-%20Climate%20related%20risks%20and%20opportunities.pdf

[19] World Bank (2020). Pension Systems + Climate Risk: Measurement + Mitigation. Available here: https://documents1.worldbank.org/curated/en/143231601016562164/pdf/Pension-Systems-Plus-Climate-Risk-Measurement-Plus-Mitigation.pdf

[20] Amenc, N., F. Blanc-Brude, A. Gupta, B. Jayles, D. Marcelo, and J. Orminski (2023). Highway to Hell: Climate Risks Will Cost Hundreds of Billions to Investors in Infrastructure Before 2050. Available here: https://ssrn.com/abstract=4779790 or http://dx.doi.org/10.2139/ssrn.4779790

[21] Amenc, N., F. Blanc-Brude, A. Gupta, B. Jayles, D. Marcelo, and J. Orminski (2023). Highway to Hell

[22] https://www.iigcc.org/insights/adaptation-resilience-why-it-matters-how

[23] https://finance.ec.europa.eu/sustainable-finance/tools-and-standards/esg-rating-activities_en

[24] https://fmsb.com/wp-content/uploads/2022/07/ESG-Ratings_FMSB_Spotlight_FINAL_v2.pdf

[25] https://www.oecd.org/content/dam/oecd/en/publications/reports/2025/02/behind-esg-ratings_4591b8bb/3f055f0c-en.pdf

[26] Pensions & Investments. Quantifying Climate Risk. Available here: https://www.pionline.com/partner-content/pi-quantifying-climate-risk/

[27] EDHEC (2025). Scientific Climate Ratings (an EDHEC Venture). Available here: https://www.edhec.edu/en/research-and-faculty/centres-and-chairs/scientific-climate-ratings-edhec-venture

[28] Scientific Climate Ratings (2025). Two Ratings, One Holistic View: Quantifying Financial Impact of Climate Risk with PCER and ECRR. Available here: https://scientificratings.com/2025/07/09/two-ratings-one-holistic-view-quantifying-financial-impact-of-climate-risk-with-pcer-and-ecrr/

[29] How to Assign Probabilities to Climate Scenarios (2025) Riccardo Rebonato, Lionel Melin, Fangyuan Zhang – EDHEC Climate Institute White paper available at https://climateinstitute.edhec.edu/publications/how-assign-probabilities-climate-scenarios

[30] EDHEC Climate Institute (2025). ClimaTech Project: The Business Case for Implementing Efficient Climate Risk-Reduction Strategies. Available here: https://climateinstitute.edhec.edu/climatech-project