From Hazards to Losses: Our CSO on the Financial Cost of Physical Climate Risk

From floods and wildfires to rising heat and storms, physical climate hazards are increasingly disrupting infrastructure, supply chains, and asset value. But how do these risks translate into financial losses, and how can they be measured?

In this Q&A, Anthony Schrapffer, Chief Scientific Officer at Scientific Climate Ratings, explains how physical climate risks impact asset valuation, why they matter for investors and issuers, and how the robust methodology of his ratings agency turns climate data into financially material insights.

Q1. In what way are physical risks financially material? Why should investors and issuers care about these hazards?

Physical climate risks are financially material because they affect cash flows and create both operational and reputational risks. They can increase supply chain costs and reduce demand, making them a direct concern for investors and issuers.

Acute physical risks, which are event-driven hazards, cause sudden disruptions and losses. A company asset can be directly affected by hazards such as coastal floods that damage physical assets or hurricanes that close ports or refineries, requiring costly restarts. Indirect impacts can also be non-negligible, as a flood that inundates a key supplier can halt production for weeks, as was the case with rail manufacturer Stadler in Valencia (Spain) in 2024. Wildfire liabilities have also pushed a major California utility to the brink of bankruptcy following the 2018’s Camp Fire, illustrating the solvency risk that arises when hazards escalate.

Floods in Valencia, Spain, was the deadliest in the country’s modern history, and caused significant disruption and economic losses. (Image credit: Canva)

Chronic physical risks, which refer to changes in average climate conditions, erode performance over time. Rising heat reduces productive hours in construction and logistics; water scarcity forces curtailments at mines, food processors, and chip fabs; repeated low Rhine River levels have constrained barge traffic, raising chemical producers’ transport costs; sea-level rise and more frequent flooding depress coastal real estate values and require expensive adaptation measures for ports.

For investors and issuers, physical risks are a core risk factor. Firms that make their activities more resilient, reduce their asset exposure to climate risk through adaptation measures, diversify supply, secure water/energy, and adapt to future climate conditions can protect their activities, reduce risk and potentially find opportunities.

Q2. Which physical risks does Scientific Climate Ratings focus on? Are there any hazards particularly relevant to asset-level financial risk management?

We focus on floods, wildfires, storms (tropical cyclones and extratropical storms), and heat (especially its impact on labor productivity) because these perils are among the most financially material (WMO, 2023; Munich Re, 2025; OECD, 2024) and have robust scientific and actuarial literature that enables credible quantification of losses, considering both intensity and probability factors.

Q3. What type of uncertainty do you encounter when modelling physical risks?

Physical-risk modelling inherits three core layers of scientific uncertainty.

Scenario uncertainty comes first: future losses differ depending on the scenario (SSP1-1.9 vs SSP5-8.5), so any asset-level estimate must be conditional on a pathway range.

Model (structural and parametric) uncertainty is next, different global and regional climate models, flood-depth curves, or wildfire–spread simulators yield divergent hazard intensities.

Climate scenarios are key for risk assessment. (Image Credit: Canva)

Internal (natural) climate variability, the year-to-year swings that exist even with identical forcing, adds noise that is proportionally larger in the near term and at local scales.

Other uncertainties compound the picture and matter for asset-level risk management. This is the case for the climate data resolution as well as the exposure and vulnerability data (e.g., damage function, geo-sectoral specificities).

Behavioural factors such as future adaptation investments introduce adaptive-response uncertainty. We deal with this uncertainty by engaging directly with the asset owner to include any adaptation response implemented or to be implemented. Finally, extreme-tail and cascade risks are hard to capture.

Q5. What key metrics and data inputs do you use to assess physical risk exposure and its financial impact? How do you compute rating scores for these risks?

We obtain information from climate projections (multi-model ensembles), hydrological–hydraulic models (flood depth), and satellite/remote-sensing data to map the potential event intensities across event probabilities.

This information is combined with exposure (asset geolocation, sector of activity, adaptation measure implemented) and vulnerability functions to compute expected damages and revenue losses.

We then convert these into risk scores directly tied to financial materiality in comparison to the other assets assessed.

Q6. How do your ratings differ from those of global competitors? What makes your methodology stand out?

Our ratings differ because we move from hazard-only exposure to decision-grade, asset-level financial risk.

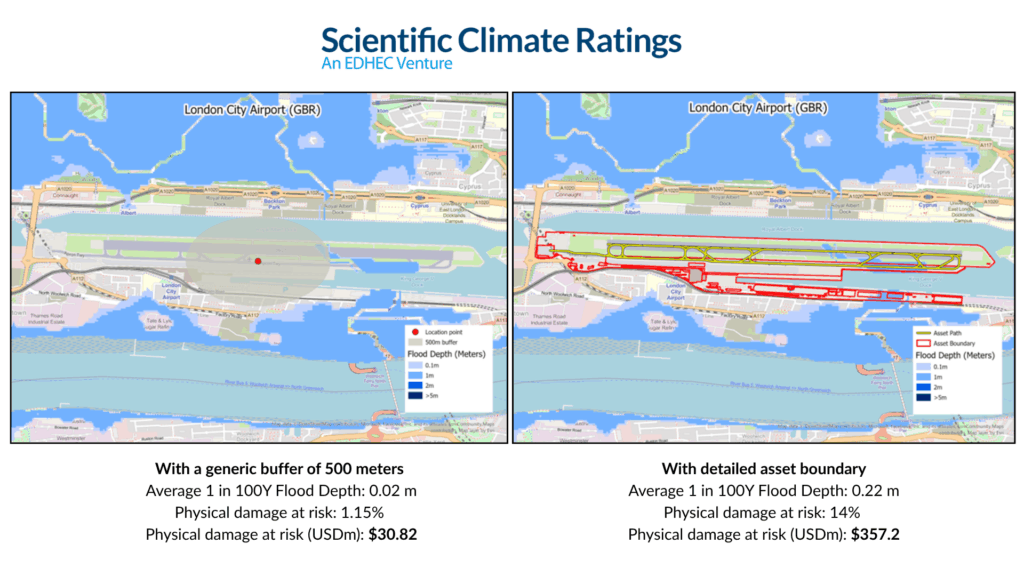

We use hazard-specific, high-resolution information and intersect them with each asset’s precise shapefile footprint (not just a point and a radius).

This captures asset-specific risk and produces an estimate of damages that reflects how the asset is built and operated.

Scientific Climate Ratings uses high-resolution geospatial data using detailed asset boundaries (on the right) to provide accurate analysis, compared to traditional solutions (on the left) that uses a radius approach, which overlooks the physical damage at risk.

We then translate these hazard damages into an impact on asset value using advanced financial loss models, including both damages and impact on revenues as well as capital and operational expenditure related to the implemented adaptation measure.

Unlike “what-if” approaches, we probabilise scenarios so users can reason in expected outcomes. Our infrastructure expertise, grounded in EDHEC’s research and the TICCS classification, enables us to tailor vulnerability and impacts to well-designed asset classification. Together, these features make our outputs asset-specific, financially comparable, and portfolio-ready.