From extreme weather to policy disruption, climate risks manifest in two distinct yet financially relevant forms: Physical and Transition.

These risks are urgent and material, with significant financial impacts, especially for infrastructure projects with long investment horizons.

Exposure to physical risks such as floods and heat stress can result in a significant loss in value for infrastructure assets. According to a study by Scientific Infra & Private Assets, an EDHEC venture, these risks could risk more than 50 percent of the value of infrastructure investors’ portfolios before 2050 in the event of a runaway climate change.

At Scientific Climate Ratings, we assess both to provide a comprehensive view of climate-related exposure and quantify their financial impact.

Below, we outline the key distinctions between these two categories, translating complex dynamics into clear, actionable insights.

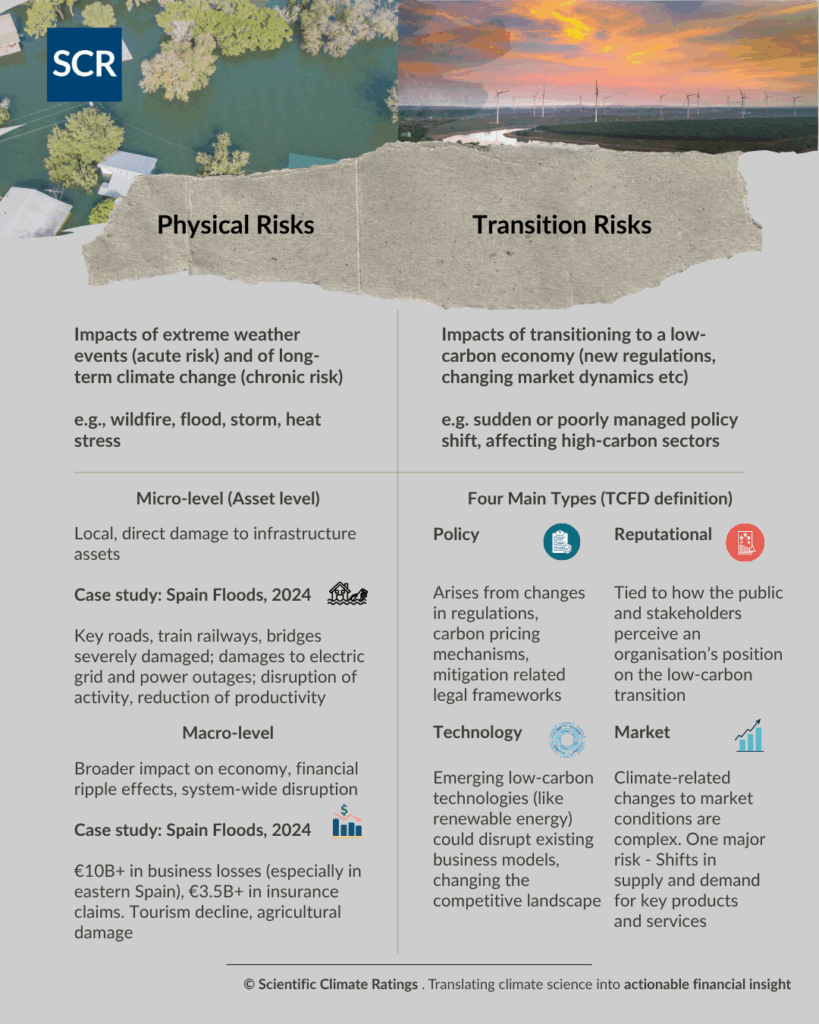

Physical Risk

It arises from direct climate impacts, such as extreme weather events and long-term environmental changes.

They can be acute (e.g. floods, wildfires) or chronic (e.g. rising sea levels), and they cause immediate, observable damage to assets and operations.

The 2024 Spain floods offer a concrete example of physical risks in action, illustrating how localised, asset-level (micro) disruptions can scale into broader (macro-level) economic consequences.

At the micro level, critical infrastructure such as roads, bridges, railways, and power grids was severely damaged, leading to immediate operational disruptions. At the macro level, the floods triggered insurance claims exceeding €3.5 billion and caused an estimated 0.2 percentage point drop in GDP for the fourth quarter of 2024, according to the Bank of Spain. The total damage to businesses was estimated to be over €10 billion.

Transition Risk

It derives from the global shift towards a low-carbon economy.

These risks are categorised into four main types by the Task Force on Climate-related Financial Disclosures (TCFD): policy, reputational, technological, and market.

Although less visible, they can have a significant impact on asset valuations and long-term financial viability.

Both types of risk require careful consideration within financial planning and investment strategies.

Our infographic below highlights their key distinctions and real-world relevance.

The methodology of SCR derives from a combined approach, computing exposure to physical and transition risk and quantifying their financial impact.

The ratings measure the localised damage and disruption to infrastructure assets and their operations caused by extreme climate events, and quantify the financial impact of climate risks on Net Asset Value (NAV).

They also capture exposure to transition risks and assess their financial impact based on direct and indirect carbon emissions of companies.

Explore our detailed documentation to learn more:

To find out more about how we assess these risks, explore our platform.

Discover research papers by EDHEC Climate Institute on physical risks.

Further Readings: