From “What Ifs” to “What’s Likely”: Why Scientific Climate Ratings Use Scenario Probabilities

Climate scenario models often extend far into the future, typically to 2050 or even 2100, well beyond traditional financial planning horizons.

As Mark Carney described in his now well-known speech, climate change presents a “tragedy of the horizon,” where short-term financial decision-making fails to account for long-term consequences.

Climate risk is, therefore, highly uncertain, with widely varying outcomes.

Most models represent possible futures based on specific assumptions.

Yet, they rarely indicate the likelihood of those outcomes.

In most cases, financial decision-makers select a single scenario, typically a worst-case, without assigning probabilities or multiple pathways.

“Anticipating the worst,” and the exaggerated figures this can produce, may be suitable for stress testing, but it is poorly suited for long-term planning or risk pricing.

Understanding the Trade-Off Between Physical and Transition Risks

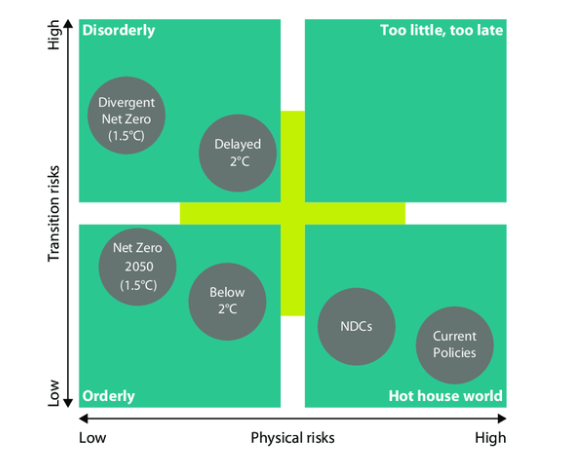

Most scenario models reflect a trade-off between the two—when physical risks are high due to weak regulation, transition risks are typically low. Conversely, when transition risks are high due to significant climate regulation, physical risks are reduced.

Climate risk includes both physical and transition risks, and there is often a trade-off between the two:

When emissions remain high, physical risks increase, but transition risks stay low due to limited regulation.

On the contrary, strong climate regulation reduces physical risk but raises transition risk through adjustment costs.

Most scenarios fall into one of these extremes.

The NGFS scenario matrix illustrates this trade-off—each bubble represents a scenario. Current models ask users to select one bubble, often the worst-case scenario, without indicating its likelihood of occurence.

From “What Ifs” to “What Is Likely”: Probability-based insights across multiple climate pathways

A probabilistic approach adds what’s missing:

- It brings these outcomes together and combines probability with consequence.

- It captures a full range of plausible futures.

- It supports forward-looking planning and decision-making.

Scientific Climate Ratings, developed using extensive research by the EDHEC Climate Institute (ECI), moves beyond single-scenario “what ifs” to structured, probability-based insights across multiple climate pathways.

In a new study by ECI, Riccardo Rebonato, Lionel Melin and Fangyuan ZHANG propose a novel framework for attributing probabilities to long-term climate scenarios. This responds to a critical shortcoming in existing scenario analysis tools used in financial regulation and investment strategy, which typically lack a probabilistic dimension. The authors argue that without probabilities, scenarios are limited in their ability to inform risk-adjusted decision-making.

Download the white paper here: “How to Assign Probabilities to Climate Scenarios”.