Why SCR Uses ClimaTech—The World’s Largest Database of Decarbonisation and Resilience Strategies in Infrastructure

Infrastructure is highly vulnerable to climate risk, as it involves “long-term” fixed-location assets that cannot be easily relocated.

Physical risks, such as floods and fires, and transition risks associated with the shift to a low-carbon economy pose significant threats to infrastructure assets, including devaluation, poor investment choices, and exposure to potential regulatory shifts.

Research by the EDHEC Infra & Private Assets Research Institute (EIPA) reveals the substantial financial impact of climate risks: physical risks could result in a 50% loss in value for the most exposed portfolios, while transition risks could lead to losses exceeding 600 billion dollars for infrastructure investments alone.

Despite the recognised need for climate-resilient infrastructure, there is a significant gap when it comes to assessing their exposure to climate risks with science-led, forward-looking and decision-useful ratings.

There is also a notable lack of clear and accessible data from companies regarding their decarbonisation and resilience strategies, relevant technical information, and risk mitigation for infrastructure assets.

As a result, evaluating whether their strategies are successful in the face of interconnected impacts of climate risks is more challenging.

The ClimaTech Project, a primary feature of Scientific Climate Ratings (SCR) developed by the EDHEC Climate Institute, was established to address these challenges by providing the largest global repository of technology-based decarbonisation and physical risk reduction measures tailored for infrastructure.

ClimaTech facilitates the integration of engineering and design strategies, offering a critical view of their effectiveness, supported by a comprehensive and comparable database that draws insights from more than 200 academic papers, technical documents, and government reports.

How ClimaTech Works

Backed by two years of applied research, ClimaTech offers a science-based matrix that maps strategies by infrastructure type, enabling evidence-based decisions and enhancing resilience.

The project features a listing of the most effective strategies and sector-specific technologies, accompanied by expert analysis and quantified effectiveness indicators based on applied research.

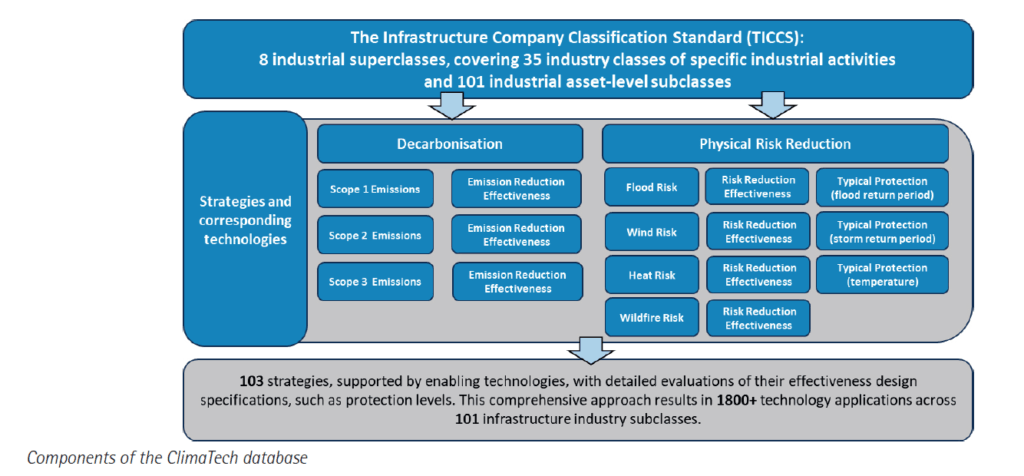

The ClimaTech database:

- Includes 103 strategies covering both transition (Scopes 1, 2, and 3) and physical climate risks (including floods, storms, heat, and wildfires), linking them to 101 subclasses.

- Classifies infrastructure assets into eight industrial superclasses, comprising various sectors, including conventional power, transport, networked utilities, data, renewables, water infrastructure, environmental services, and social infrastructure.

- Assesses each strategy for its relevance, effectiveness, key enabling technologies, and protection levels offered by physical risk reduction strategies in terms of return periods, resulting in over 1,800 evaluated applications.

Methodology: A Scientifically Grounded, Top-Down Framework

ClimaTech is built on a scientifically rigorous, top-down methodology that translates climate research into actionable insights. It begins with a comprehensive review of the scientific and technical literature to identify the most impactful current and emerging decarbonisation and resilience strategies, along with the enabling technologies required for their implementation.

For decarbonisation, the framework identifies effective strategies targeting Scope 1, 2, and 3 emissions, evaluates the technologies that enable them, and estimates their potential to reduce emissions in practical, sector-specific contexts. For resilience, it assesses strategies designed to reduce physical climate risks such as floods, storms, heat, and wildfires, and quantifies their typical level of protection, expressed through metrics such as return periods or performance thresholds relevant to each hazard type.

To ensure scientific robustness and relevance to investors, the research outputs undergo validation by a Review Committee of experts from academia, infrastructure investing, sovereign wealth funds, consulting, regulation, and the private sector.

How Scientific Climate Ratings Uses Climatech

SCR draws on this structured, comprehensive and evidence-based framework, empowering stakeholders to understand asset-specific climate risks in a systematic and actionable way, thereby bridging the gap between climate science and financial insights.

The ratings utilise the provided indicators of ClimaTech on strategies’ effectiveness to re-evaluate exposure to climate risks and their financial impact and adjust its two complementary ratings: The Potential Climate Exposure Rating (PCER) and the Effective Climate Risk Rating (ECRR).

ClimaTech offers a key advantage, as the framework provides the much-needed data, precision, and comparability in climate risk assessment, supporting long-term financial decision-making and resilience in infrastructure.

By using ClimaTech as a foundation, SCR begins with a consistent and science-based assessment of climate risk across asset types. However, what makes this approach more reflective of reality is that it does not stop there; it also adjusts for the strategies that have actually been implemented or are going to be implemented. This means that an asset is not judged purely on exposure, but also on the measures taken to mitigate that exposure.

This adjustment is critical because most infrastructure assets are already built and functioning. Simply identifying the risk is not sufficient— what matters is whether the asset has taken credible steps to reduce it, and to what extent. By accounting for this, the ratings produced by SCR go beyond theoretical vulnerability and reflect the true, current state of the asset, enabling more meaningful comparisons and better-informed investment decisions.

Explore our data and methodology.

Learn more about the ClimaTech Project | EDHEC Climate Institute.

Further Reading

Resilience & Transition Tech | EDHEC Climate Institute