Scientific Climate Ratings: from exposure to financial impact: a new standard in climate risk ratings

The Climate Risk Rating (CRR)

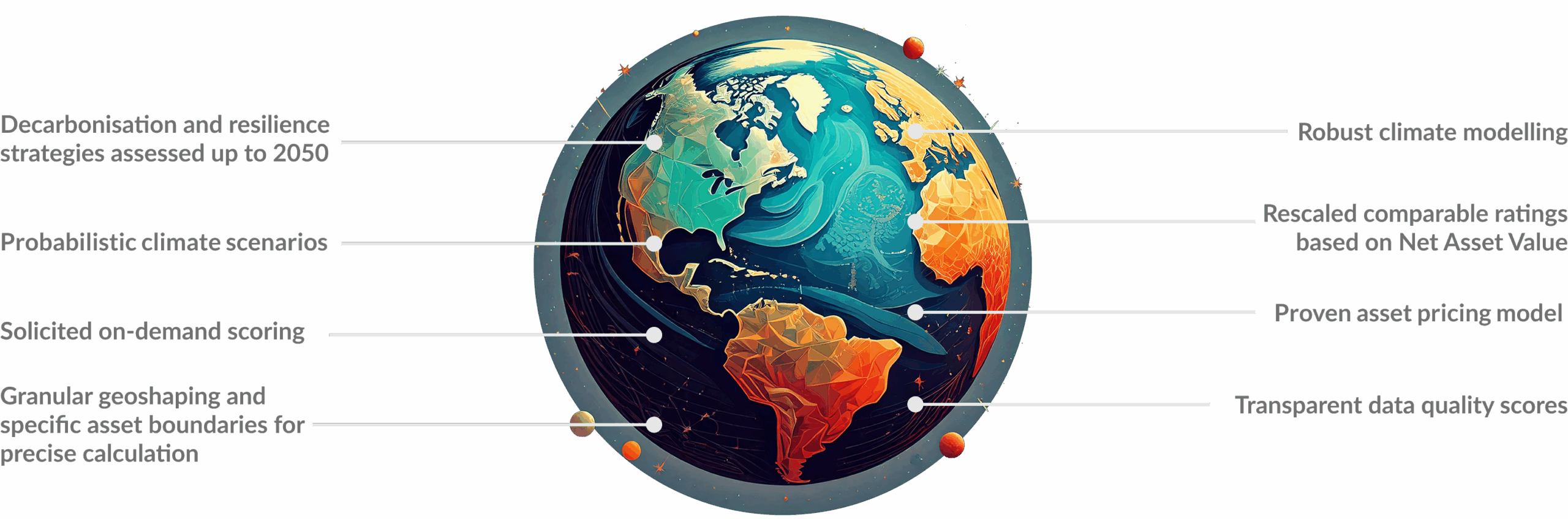

The CRR is a primarily solicited rating that quantifies the expected financial impact of climate risks across multiple scenarios and over two time horizons.

Our Methodology

Underlying Key Inputs

How financially material are climate risks for me?

- Advanced climate risk ratings for corporates and investors

- Transparent and robust science-based asset price models

- Decarbonisation and resilience measures factored in

- Quantified forward-looking impact under multiple climate scenarios

- Granular data for advanced reporting and risk management

Methodology Documents

CRR

methodology

Data Quality

Score

Discover more about our physical and transition risk methodologies

Decoding Climate Risk Rating: Find the Answers You Need (FAQ section)

Infrastructure assets are particularly susceptible to physical risks, which are influenced by factors such as location, design, and size. Both acute and chronic risks can inflict significant damage, exposing companies to direct financial impacts.

Our research reveals that transition risks could result in over USD 600 billion loss for infrastructure investments. Furthermore, physical risks have the potential to reduce the value of the most vulnerable portfolios by up to 50 percent.

The metrics used for the CRR are based on companies’ Net Asset Value (NAV), offering a more accurate reflection of how physical and transition risks impact their cash flows and overall value. For this reason, we refer to it as a ‘risk’ rating rather than an ‘exposure’ rating.

We have chosen not to include insurance coverage in the CRR for a fundamental methodological reason: the mismatch between the short-term nature of insurance contracts and the long-term horizon of our ratings. The CRR estimates climate-adjusted expected returns over forward-looking timeframes, such as until 2035 and 2050, consistent with widely used climate scenarios. By contrast, insurance policies—whether for physical asset protection or business interruption—are typically annual contracts, subject to frequent changes in terms, coverage limits, and premiums. No insurance contract provides a credible guarantee of protection over the multi-decade period that matters for climate-adjusted financial assessments. Including such short-term, conditional instruments would, therefore, risk misrepresenting long-term climate resilience and introduce inconsistencies across rated entities. Furthermore, as climate-related risks escalate, insurability may diminish, especially in high-exposure sectors or geographies.

The CRR evaluates the effective transition and physical risks until two time horizons, 2035 and 2050, for all major climate scenarios. We calculate our risk metrics based on future macroeconomic outcomes (e.g., carbon emissions, socio-economic developments, and technological advances), influenced by climate change under various conditions. In the CRR, we weigh these scenarios according to their likelihood to capture the range of plausible futures and incorporate these insights into our risk assessment. We assessed the likelihood of climate scenarios based on the probability distribution of the aggressiveness of abatement speed. This probabilistic approach prevents reliance on extreme or overly simplistic assumptions and enables a more balanced evaluation of expected outcomes and tail risks. It allows for a systematic way to account for uncertainty in the speed and effectiveness of emissions abatement efforts, which is a major determinant of future climate and economic conditions. For more details on the methodology and calculations, please refer to our document on scenario probabilisation.

All our model results undergo rigorous validation to ensure their accuracy, including comparisons with past phenomena and real-time events, sector and company reports, and latest research and expert evaluations. Our methodologies are developed and continuously reviewed by leading academics, and we maintain full transparency by providing our model documentation and data sources.

- Reporting granular data: We offer climate-related, specific, and granular data for TCFD, ESRS, and IFRS S2 disclosures, including GHG emissions (all scopes), and physical and transition risk metrics in both monetary and relational terms.

- Monitoring future risks: Multiple climate scenarios with varying time horizons help monitor future physical and transition risks for sustainable business planning.

- Comprehensive climate analysis: Our ClimaTech database supports evaluating technology opportunities for decarbonisation and resilience strategies. These adaptation and mitigation measures allow us to adjust companies’ risk exposure accordingly.

- Financial risk evaluation: Transparent and robust materiality metrics allow for integration into financial risk management and valuations.