Scientific Climate Ratings: From Exposure to Financial Impact – A New Standard in Climate Risk Ratings

The Potential Climate Exposure Rating (PCER)

Our Methodology

Underlying Key Inputs

Company-level emissions intensity

What is my exposure to climate risks?

How do I rank versus peers?

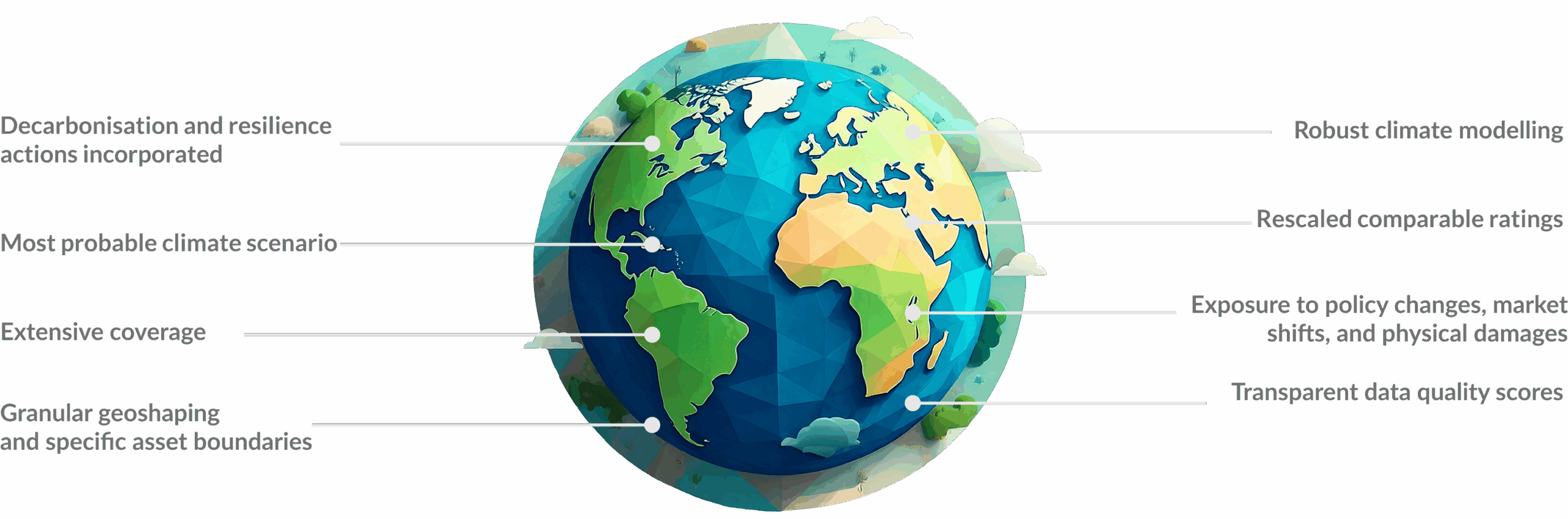

- Easy-to-use climate exposure ratings for corporates and investors

- Transparent and robust science-based models, capturing assets’ specificities

- Decarbonisation and resilience measures factored in

- Using forward-looking climate scenarios

- Useful and comprehensive benchmarking tool

Methodology Documents

PCER

methodology

Data Quality

Score

Discover more about our physical and transition risk methodologies

Decoding Climate Exposure: Find the Answers You Need (FAQ section)

We provide you with scientific, granular, and precise information to understand climate risks and make well-informed decisions for a sustainable future of your business. Specifically, we offer:

- Long-term asset protection: Infrastructure investments are long-term, capital-intensive commitments, but climate hazards and natural disasters can threaten the security and lifespan of assets. Identifying and mitigating climate exposure is vital to ensure asset longevity, reduce service disruptions, and safeguard investment value. Our solution offers in-depth, asset-specific evaluations of potential climate exposure, ensuring accuracy and relevance.

- Risk management: Extreme weather events such as floods can cause significant damage to infrastructure, driving up repair costs, increasing maintenance, and possibly reducing asset value. Assessing and managing these risks is crucial for investors aiming for stable financial returns. Using scientific methods and validated principles, we ensure reliability and consistency in our assessments.

- Insurance: As climate change intensifies, certain regions are becoming uninsurable. By understanding climate hazards' severity and likelihood, investors can tailor coverage, negotiate premiums, and take measures to protect their assets.

- Regulatory compliance: With stricter regulations on infrastructure safety and climate resilience, investors must ensure their assets comply with these evolving standards to minimise legal and regulatory risks. Investors and asset owners can use our data for reporting purposes and to assess their regulatory compliance.

- Consistent benchmarking: With over 6,000 rated infrastructure assets across 8 TICCS® industrial superclasses, Scientific Climate Ratings provides a common language for investors to compare their climate exposure against industry peers.

Yes! PCER considers resilience and decarbonisation measures. For this, we require detailed company information that can be provided through a questionnaire. We assess this company-specific data using ClimaTech, the world’s largest database of climate resilience and decarbonisation strategies, developed by EDHEC Climate Institute. This resource provides detailed information on the effectiveness of strategies to mitigate risks, adapt to climate change, and enhance resilience. After the data assessment, we adjust companies’ ratings accordingly.

We evaluate companies’ measures on :- Decarbonisation: based on adopted technologies and their ability to reduce Scope 1, 2, and 3 emissions

- Resilience: based on technologies that protect assets from climate hazards and reduce expected damage